1. Pezman’s Story: Inspiration

2. What is Silicon Valley Optimism: What is your superpower?

Pezman’s superpower

1.

Networking Skills: Nozad’s transition from selling carpets to entering the venture capital world was significantly aided by his exceptional networking skills. At his carpet store, he strategically located himself in Menlo Park, near Silicon Valley, which enabled him to build relationships with tech executives, lawyers, and financiers who frequented his shop.

2.

Vision and Opportunity Recognition: His ability to recognize early the potential of emerging tech companies and entrepreneurs set him apart. He understood the transformative impact technology was having and could identify promising startups, often before they became mainstream.

3.

Leveraging Relationships: Nozad effectively leveraged the relationships he built over time. These relationships were not just beneficial for business dealings but also helped him gain insights into the venture capital industry, eventually leading to the establishment of his firm, PearVC.

4.

Adaptability and Learning: Transitioning from a completely different industry, Nozad demonstrated a remarkable ability to learn and adapt. He immersed himself in the tech world, understanding its dynamics and what it takes for startups to succeed, which is crucial for any venture capitalist.

5.

Resilience and Perseverance: His path wasn’t straightforward. Starting from a point where he was new to the country and the tech industry, his journey required immense perseverance and resilience, facing and overcoming numerous challenges along the way.

Nozad funded Matt’s venture, Danger, at a time when non web-based technology companies struggled to raise money. Hershenson recalled: Danger went up and down Sand Hill Road for nine months and nobody would give them money. At a time where everything dot-com was getting funded by VC money, nobody wanted to fund a smart phone. Then, finally one day Matt came home and said, “We found a guy that will give us money!” “Who?” I asked. “This guy at a Persian rug shop on University Avenue.” I replied, “You must return it—it is probably some sort of money-laundering operation.” This is how I first heard of Pejman. He invests in people no matter what they do.

“I have no idea what you guys are talking about, but I like you, so I think I should give you money. I’m going to have you chat with some people that I know that know about what you do.”

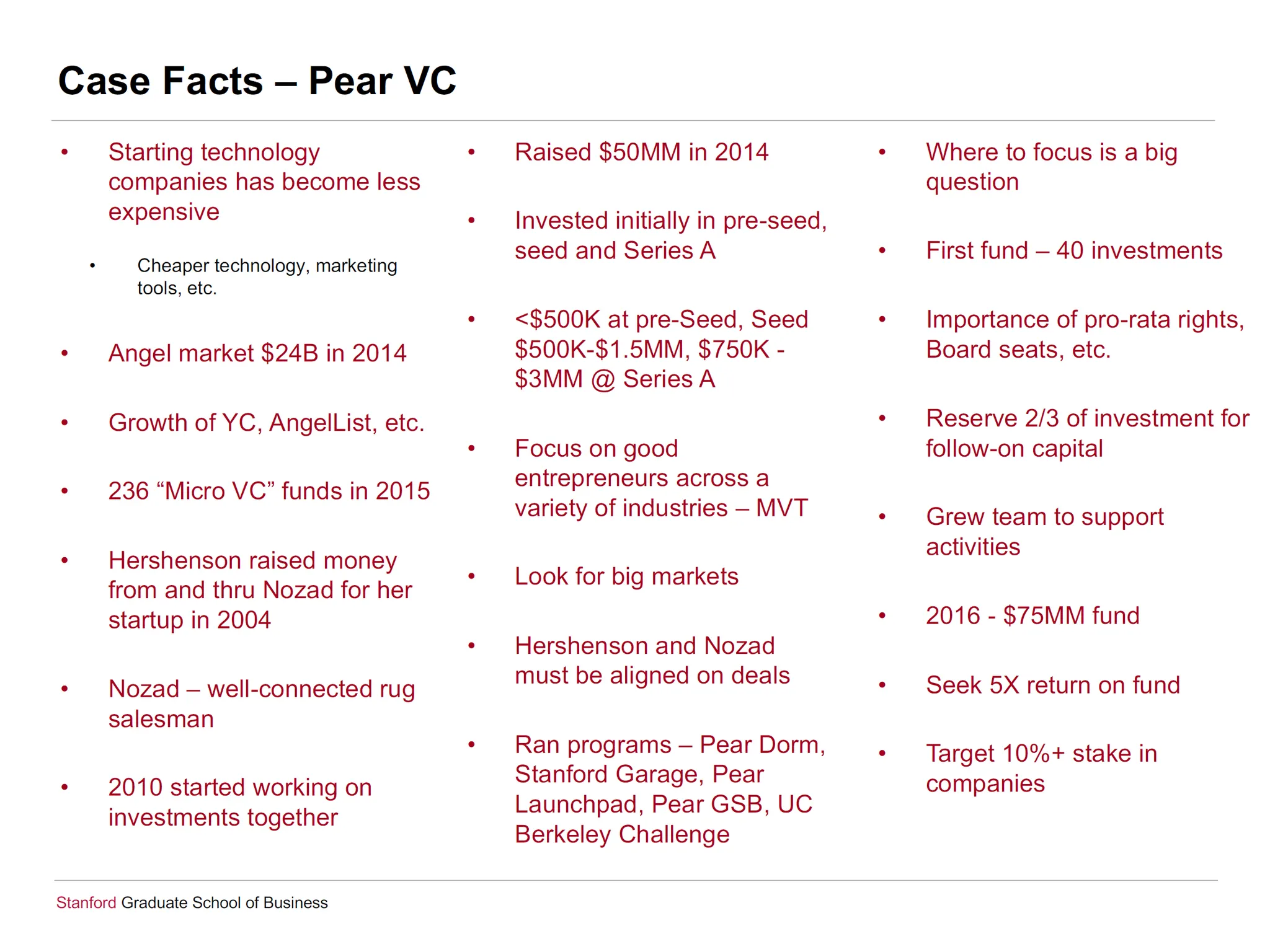

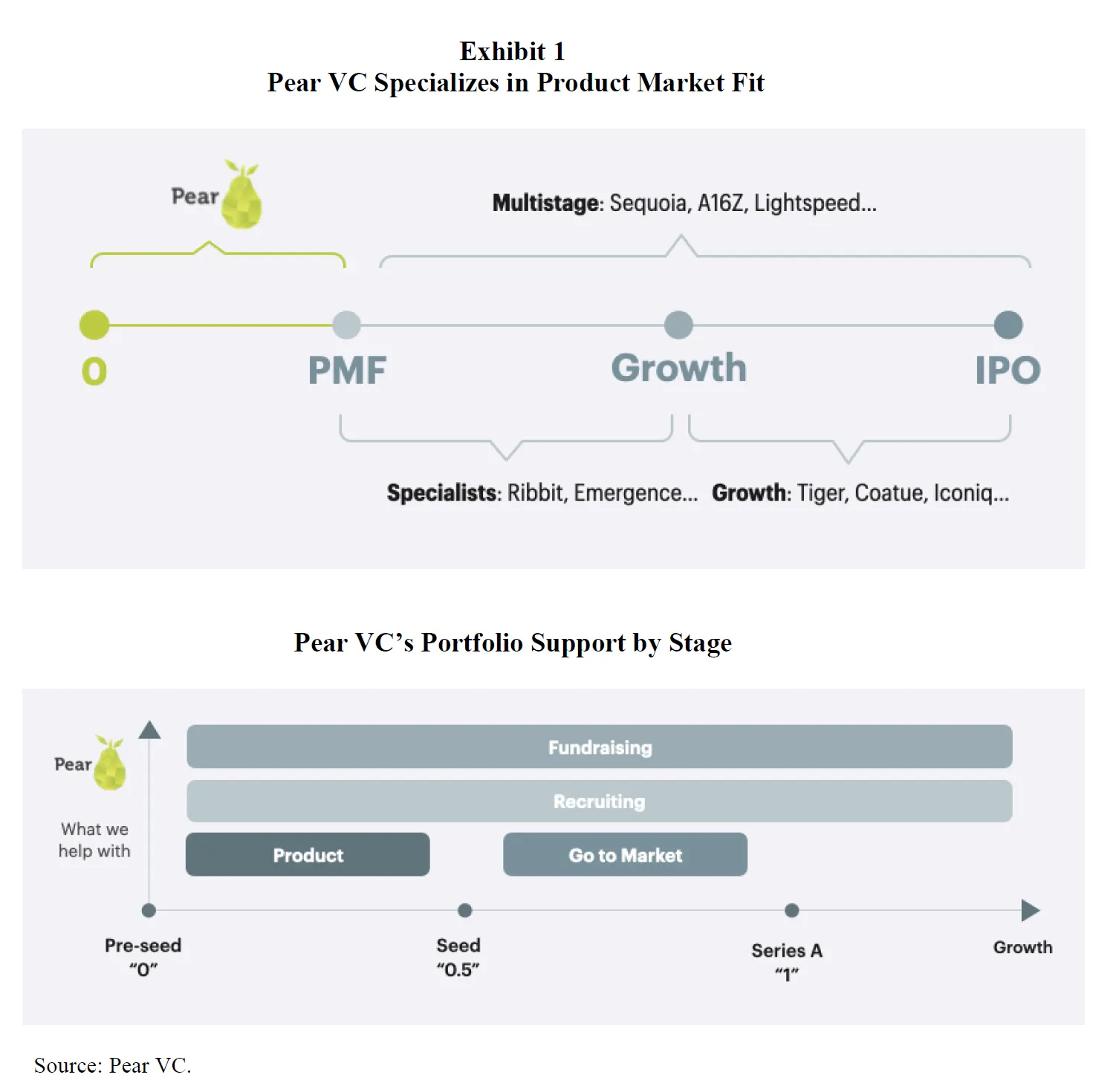

Pear’s Investment Strategy

Pear made initial investments in start-ups spanning three stages of company development: 1) preseed, which Pear termed “soil”; 2) seed; and 3) Series A.10 Founders or teams at the pre-seed

stage did not necessarily have a product or even a specific problem to solve. Pear invested at the

pre-seed stage because Hershenson and Nozad believed strongly in an entrepreneur or team and

had confidence that, with the appropriate resources and mentorship, the founders would ultimately develop a solid company. Nozad elaborated: “At the pre-seed stage, we’re looking for teams that don’t yet have a working product. Ideally, they have a prototype, but a prototype isn’t necessary if we find the right entrepreneurs.”11 Pear invested up to $500,000 per company at the pre-seed stage.

We like teams that have a history together, whether they worked together at Google, went to the same high school, or go rock climbing every weekend. We like teams, and especially CEOs, who are willing to walk through walls to make something happen. We like founders who are paranoid in a healthy way—those who are confident in where they’re going, but question themselves every day. This was the case with the Kindred Prints founders, who eventually pivoted away from their photo idea to a new idea related to in-app communications. Their new company, Branch, gained rapid traction, and is a great example of the fact that strong teams find a way to succeed, regardless of their initial ideas.

•

Stanford Garage

•

Pear Launchpad

•

Pear GSB

•

UC Berkeley Challenge

PRE-SEED ROUNDS – PEAR ACCELERATOR

Pear started investing in Pre-Seed rounds before the term “Pre-Seed” was even coined. In fact, Nozad initially referred to the stage as “Soil” in reference to creating ideal conditions to plant a seed. While the term didn’t catch on, its commitment to investing in very early-stage ventures was a cornerstone of Pear’s investment strategy. Hershenson explained, “Pre-Seed is a white-board-heavy phase of a company’s growth.” In Pre-Seed rounds, Pear invested $500K to $750K in ventures that had a strong idea but often had neither a product nor paying customers.

In this stage, Pear worked with founders to validate customer demand and conducted market research to build a minimal viable product. Nozad said: “At the Pre-Seed stage, a prototype isn’t necessary if we find the right entrepreneurs.” Since companies at that stage often had no product, Pear’s investment decision was largely driven by Pear’s belief in the entrepreneurs. Hershenson explained, “One thing I’ve learned in venture investing is to think about the rate of progress. By this I mean, we judge companies and founders not for where they are today but for where they are going to be 10 years from now.”

Pear invested in Pre-Seed stage companies through Pear Accelerator, a cohort program lasting 14 weeks in which accepted teams received $500K to $750K at a $10 million valuation cap as of 2022. Pear limited the size of its accelerator cohorts and only worked with approximately 15 companies at a time, equating to an acceptance rate of less than 0.5 percent in 2021. Pear believed that by maintaining a smaller cohort size and providing tailored advice and resources for each company, it could increase the rate of potential success. To date, one Pear Accelerator company, Viz.ai, had become a unicorn, and overall nine Pear Accelerator companies surpassed valuations of $150 million, a more than 10 percent success rate. Hershenson explained, “The key was in Pear’s high touch approach to working with start-ups.” Pear Accelerator offered founders an opportunity to work closely with Pear partners to expedite the company’s journey to product market fit. For example, the Pear partners would guide teams in developing and iterating product hypotheses, running experiments, acquiring customers, and making product decisions. Pear also provided recruitment coaching to help founders effectively source and evaluate prospective hires. In the summer of 2021, the Pear Accelerator program culminated in a Demo Day with over 1,000 top VC investors attending. On average, the participating companies raised $3.6 million Seed rounds, led by investors including Andreessen Horowitz, NEA, and Forerunner.

PEAR GARAGE

PEAR COMPETITION

PEAR FELLOWS

PEAR FOUNDER CIRCLES